Subsidies for electrical vehicles

A new subsidy system for the purchase of electric vehicles will come into effect on January 1, 2024, when it will be possible to apply for a subsidy for the purchase of an electric vehicle from the Energy Fund via Ísland.is. Applicants enter Ísland.is with electronic IDs and complete applications with ease. The subsidy is paid to the bank account of the buyer of the vehicle.

Applications for a subsidy are made here: www.Ísland.is/rafbílastyrkir

Eligible vehicles:

- Clean energy vehicles

- Zero-emission vehicles

Eligibility covers vehicles in the following categories:

- Passenger cars in the M1 category, including taxies and rental cars

- Vans in the category N1

Subsidies for vehicles in the categories passenger cars (M1) and vans (N1):

- New vehicles in the category M1 with a purchase value of less than 10 million kr. can be subsidized for up to 900.000 kr.

- New vehicles in the category N1 with a purchase value of less than 10 million kr. can be subsidized for up to 500.000 kr.

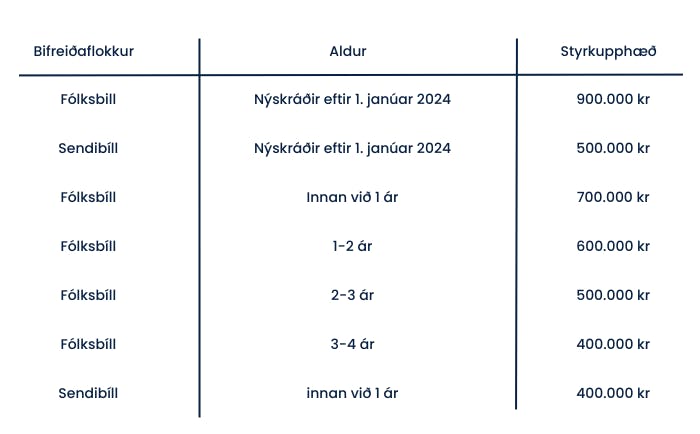

Vehicle category - Age - Subsidy amount

Just transition

With this project, the Energy Fund's board has aimed to meet the ideology of a just transition by providing subsidies regardless of the purchase price. In this way, the cheapest cars receive relatively the highest subsidies and a cap is also placed on the purchase price. Furthermore, consideration has been given to those who want to buy imported used vehicles and to vehicles specially equipped for people with disabilities.

Terms and conditions

Terms and conditions for subsidies for the purchase of vehicles that run on clean energy

Article 1: Purpose, objectives and scope.

The Minister of the Environment, Energy and Climate grants subsidies for the purchase of vehicles that have no emissions, are clean energy vehicles, or zero-emission vehicles, and their provision is in accordance with these rules. Grants go through the Energy Fund and are intended to encourage the purchase of vehicles that run on clean renewable energy in order to speed up the energy transition in transportation with the main goal of reducing greenhouse gas emissions.

The grants are awarded to individuals and legal entities who are registered as owners of grant-eligible vehicles in Iceland at the Icelandic Transport Authority. Eligibility covers vehicles in the following categories:

Passenger cars in the category M1, including taxis and rental cars.

Vans in category N1, small mini-busses in category N2, and trucks in category N3.

Coaches and busses in categories M2 and M3.

Subsidized vehicles include both new and imported used vehicles. Certain criteria apply to the maximum purchase value of vehicles in categories M1 and N1, i.e. if the purchase price exceeds a certain maximum, no grant is received.

New vehicles are considered to be first registered in Iceland as of January 1, 2024. If a vehicle is imported and used after January 1, 2024, the subsidy amount depends on the category the vehicle belongs to and, depending on the circumstances, how long it has been since its first registration abroad.

There are exceptions to these rules for vehicles in categories M1 and N1 if the vehicle is specially equipped for the needs of people with disabilities. In other respects, grant amounts take into account the advertised maximum purchase prices and grant amounts for each category of vehicle.

Vehicles in categories M2, M3, N2, and N3 are only eligible for subsidies if they are new vehicles.

Article 2: Advertisement..

The Energy Fund must advertise every year when and how it will be open for grant applications. The advertisement must contain information about the conditions that vehicles must meet in order to be eligible for funding and the rules and terms that apply to the grants. If the minister decides to submit more detailed priorities for the allocation of grants than stated in Article 1. it must be stated in an advertisement.

Article 3: Applications and payment of grants.

Applications for the purchase of passenger vehicles in category M1 and commercial vehicles in category N1 are normally carried out digitally through the applicant's electronic access to Ísland.is. Because of vehicles in the same categories that are specially equipped due to the buyer's disability, confirmation from the Icelandic Pension System (TR) must be obtained before applying on Ísland.is.

As regards grants for vehicles in categories M2, M3, N2 and N3, they will be carried out through the Energy Fund's application process following a previous advertisement.

A grant is only awarded once for each eligible vehicle. If co-owners are registered on the subsidized vehicle, the subsidy is paid to the registered main owner and he alone can apply for a subsidy.

If both the vehicle and the applicant meet all the conditions and the applicant has agreed to the terms and conditions that form the basis of the grant and are stated in the application process, the grant is usually paid out within two days after the application is received.

Article 4: Misuse of data, false or misleading information, data collection.

If an applicant is found to have provided false or misleading information to the Energy Fund regarding his application or uses a subsidy for a purpose other than the purchase of a clean energy vehicle, the fund reserves the right to invalidate the subsidy amount and require the beneficiary to repay the subsidy along with costs. All such cases will without exception be reported to the police. In this regard, the Energy Fund reserves the right to request information about the purchase, registration and ownership history of the vehicles that have been sponsored. Furthermore, it is informed that the Icelandic National Audit Office has extensive inspection powers, which include the authority to call for data and information in this regard.

Article 5: Export ban.

In order to meet the government's goal of reducing greenhouse gas emissions, the beneficiary agrees that the vehicle will only be registered in Iceland while it is in his possession.

Article 6: Validity.

These terms and conditions are active immediately.

Frequently asked questions

Where do I apply for a subsidy?

Answer: https://island.is/rafbilastyrkirHow do I apply?

Answer: You connect to Ísland.is/rafbilastyrkir with your electronic ID and provide the car number of the car you own and consider to be entitled to a subsidy.How do I get the subsidy paid?

Answer: The subsidyis paid into the bank account that the Tax Office has information about.Can I advance the subsidy to a car dealership?

Answer: No. The subsidy is only paid to the person who is the registered owner of the vehicle, and no transfer of the subsidy is possible.Why is my subsidy lower?

Answer: The car is not new and older than the vehicle you are comparing to and received a higher grant.When is the subsidy paid?

Answer: Within two days of the application being submitted.Can you apply for more than one vehicle? If yes, how many?

Answer: You can apply for a subsidy for more than one vehicle. There is no limit.What about other categories such as trucks and coaches?

Answer: The Energy Fund will advertise subsidies for heavy transport in 2024, in a similar way to what was done in 2023.Is the subsidy for everyone, individuals and companies?

Answer: Yes, the subsidy goes to the registered owner of the vehicle, note. not of the user.Why are methane vehicles not applicable?

Answer: These subsidies only apply to vehicles that have no emissions, are clean energy vehicles or zero-emission vehicles.Can I get a subsidy for a hydrogen vehicle?

Answer: Yes, if it is an electric car, that is uses a fuel cell.If I renew a vehicle every year, can I receive a new subsidy?

Answer: Yes, but subsidy amounts are expected to decrease in the coming years.Are there any size or weight limits on applicable vehicles?

Answer: No, if the car is classified under either M1 or N1 category by the Icelandic Transport Authority and is 100% electric, then it is eligible for funding.If the vehicle is specially provisioned for disabled people and costs more than 10 million kr., is no subsidy paid?

Answer: Such specially equipped vehicles are exempt from the maximum price and age criteria. All purchases of such vehicles must be approved and in cooperation with the Icelandic Pension Agency before the application is made on Ísland.isDoes the maximum purchasing price, 10 million kr., include vehicle extras?

Answer: The purchasing price is based on the vehicle, without extras.Can you sell the vehicle out of the country?

Answer: The first owner, the beneficiary, may not sell the vehicle abroad.